Housing Market Shows Signs of Rebound

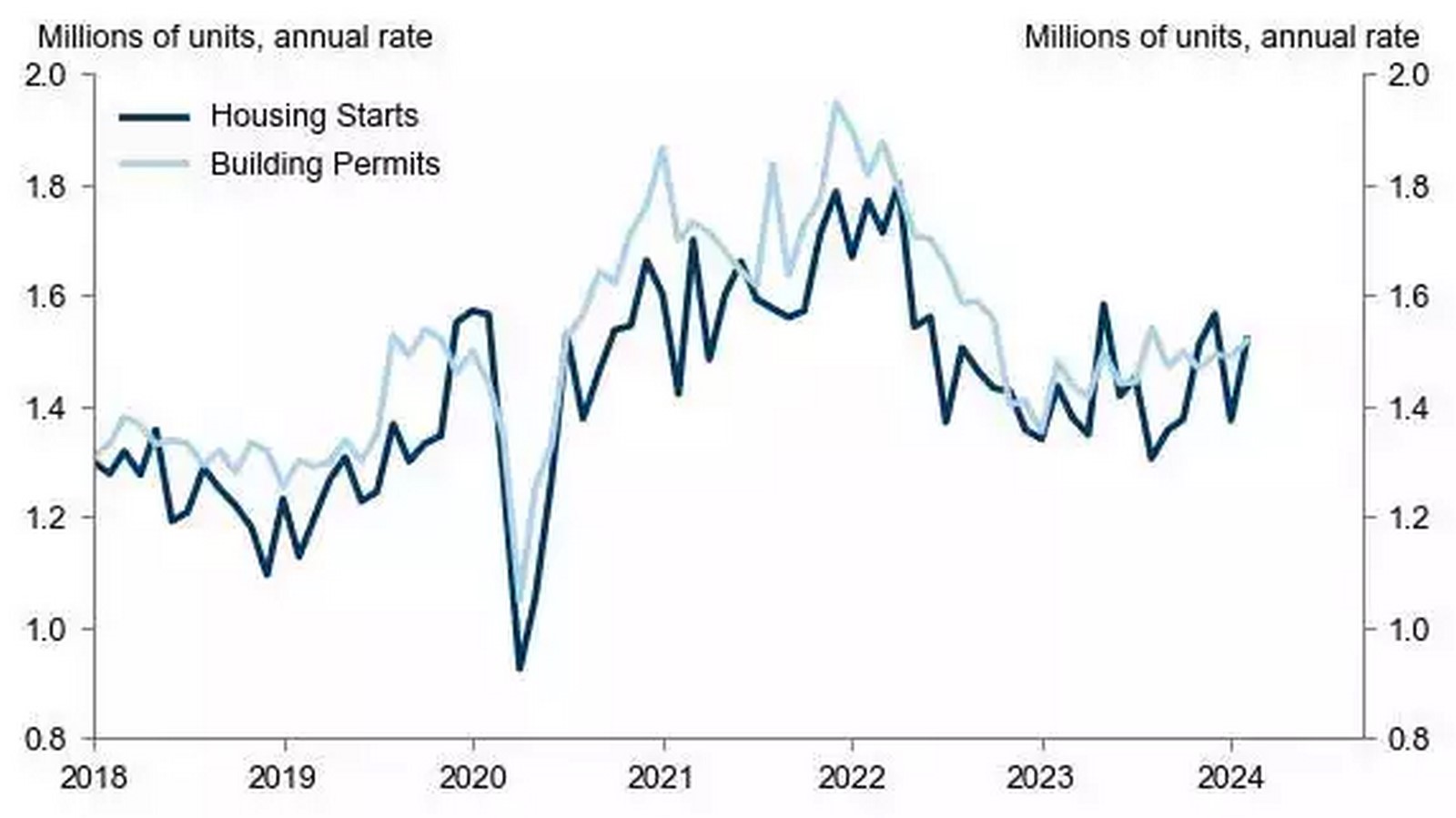

Recent data indicates a potential resurgence in the housing market after a period of subdued activity attributed to factors such as high mortgage rates, elevated home prices, and constrained inventory.

February’s Positive Indicators

In February, housing starts experienced a notable uptick, increasing by 10.7% compared to the previous month’s revised estimate. This growth surpassed the median forecast of 8.2%, according to a report jointly released by the US Census Bureau and the Department of Housing and Urban Development. Notably, this surge marked the highest gain in nine months, effectively reversing the 12.3% month-over-month decline observed in January.

Encouraging Statistics

Privately owned housing starts reached 1.521 million units, seasonally adjusted, representing a 5.9% increase from the previous year. Single-family housing starts, a significant component of the market, rose by 11.6% in February, nearing two-year highs. Additionally, building permits grew by 1.9% month-over-month, exceeding expectations with the largest leap recorded since August.

Analyst Insights

Goldman Sachs strategists highlighted the strength in housing composition, attributing four-fifths of the February increase to single-family starts and noting a concurrent rise in the multi-family starts component by 8.3%.

Positive Builder Sentiment

The NAHB homebuilder confidence index for March reflected a positive shift, surpassing the neutral threshold of 50 for the first time since July. Notably, the “current sales conditions” gauge saw significant improvement, rising from 52 to 56, indicating heightened demand for homes.

Outlook and Forecast

Capital Economics strategists anticipate divergent trajectories for single and multi-family construction over the next two years. They predict that single-family starts will benefit from limited second-hand home availability, thus driving demand towards new builds. However, they also foresee weaknesses in multi-family starts, resulting in marginal overall growth in housing starts by the end of 2025.

Potential Relief for Buyers

A more favorable housing market, coupled with improved inventory levels, may offer relief to Americans affected by the “lock-in” effect during the pandemic. Current homeowners, who have been reluctant to sell due to historically low mortgage rates, may find increased opportunities to transition, thereby alleviating some pressure on the market.