Escalating Disparity: Home Prices Outpace Inflation Since the 1960s

Skyrocketing Prices: A Historical Perspective

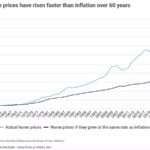

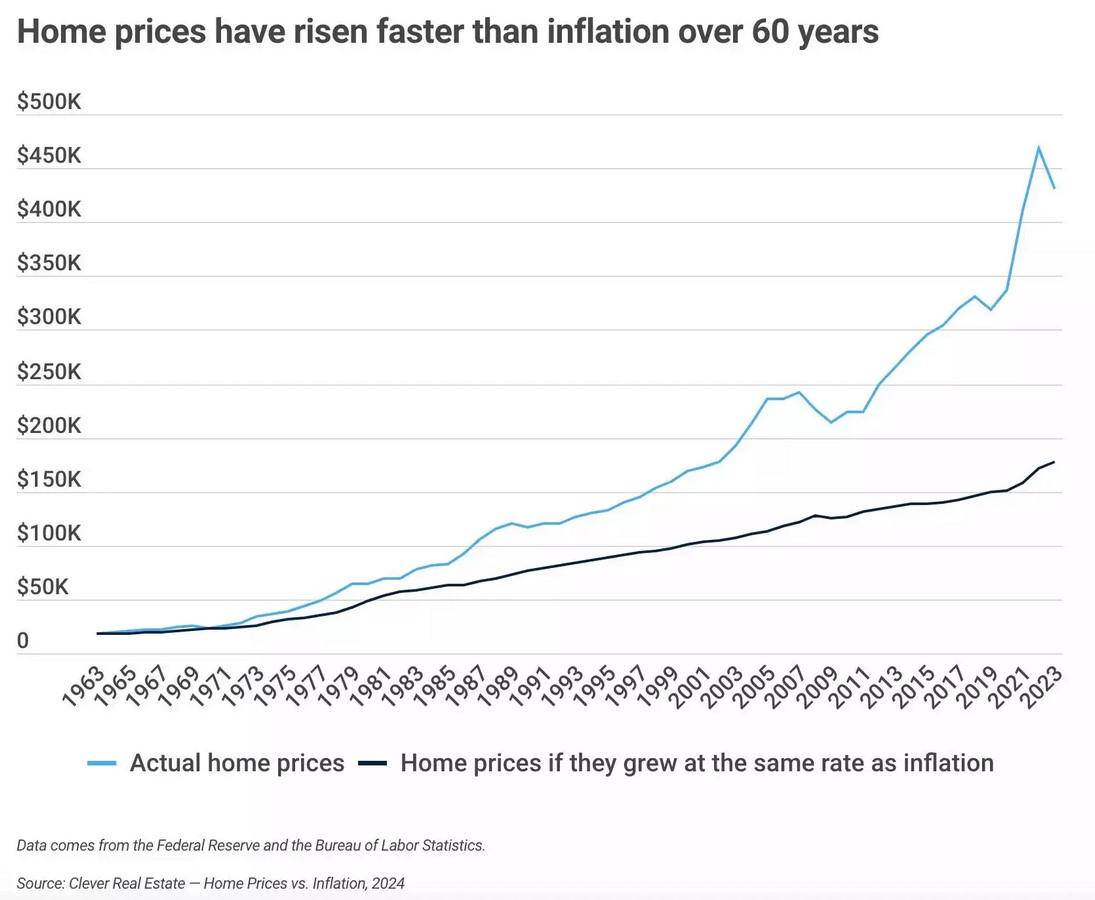

Since the 1960s, home prices in the United States have surged ahead of the inflation rate for other commodities. A recent study conducted by Clever Real Estate revealed that housing prices have escalated at a rate 2.4 times faster than inflation over this period.

Matt Brannon, the author of the report, highlighted the staggering contrast: if home prices had merely kept pace with inflation, the median home would currently cost only $177,500, significantly lower than the actual median price of $431,000.

Continued Trend: Recent Years

The trend persists even in more recent years. Since 2013, while inflation has increased by 31%, the median home price has soared by 63%. Brannon emphasized that while homeownership has always come with costs, the current scenario reflects unprecedented levels of expense.

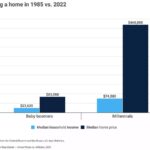

Generational Divide: Boomers vs. Millennials

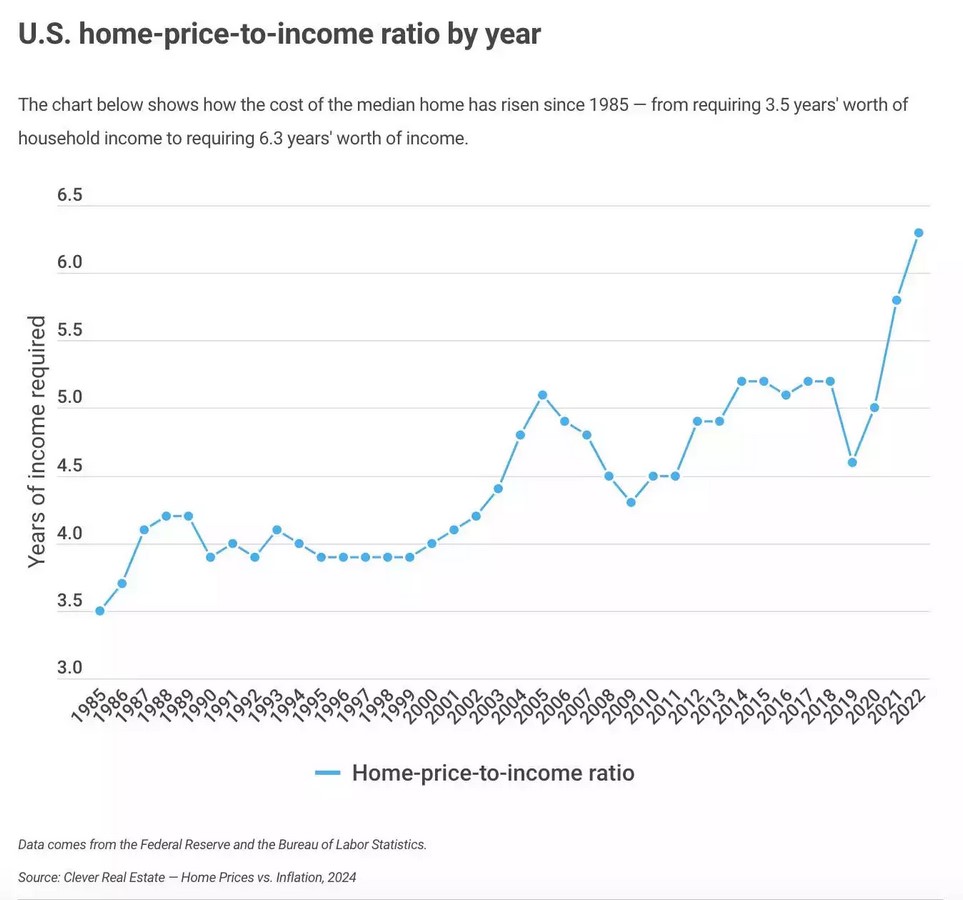

The impact of escalating home prices is particularly pronounced when comparing the homebuying landscape for baby boomers and millennials, the two largest generations in the US. The report indicates that homes are nearly twice as expensive for millennials as they were for boomers in their 30s, after adjusting for typical income levels.

Growing Financial Burden

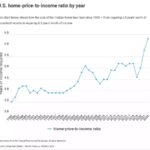

Rising home prices translate into a substantial financial burden for Americans, requiring them to allocate a larger portion of their income towards homeownership. In the 1980s, purchasing the typical home required approximately 3.5 years’ worth of household income. However, this figure has ballooned to 6.3 years’ worth of household income today, as per the study’s findings.

A separate survey by Zillow reinforces this notion, revealing that homeowners now need to earn 80% more to comfortably afford a home compared to just four years ago.

Supply Constraints Fueling Price Surge

One of the primary drivers behind the surge in home prices is a significant supply shortage, with Clever noting a deficit of 3.2 million homes. Moreover, the construction landscape is marked by a focus on larger, more expensive single-family homes, exacerbating affordability challenges. Meanwhile, a considerable portion of new construction is geared towards the rental market.

Future Projections: Concerns Ahead

If the current pricing trajectory persists, the Clever report paints a concerning picture for the future. By 2050, the median home price is projected to cost 8.4 times the median household income, highlighting the urgency of addressing affordability issues in the housing market.